Give Your Employees and Your Business a Bonus

By Mueller Financial Services, August 4, 2020

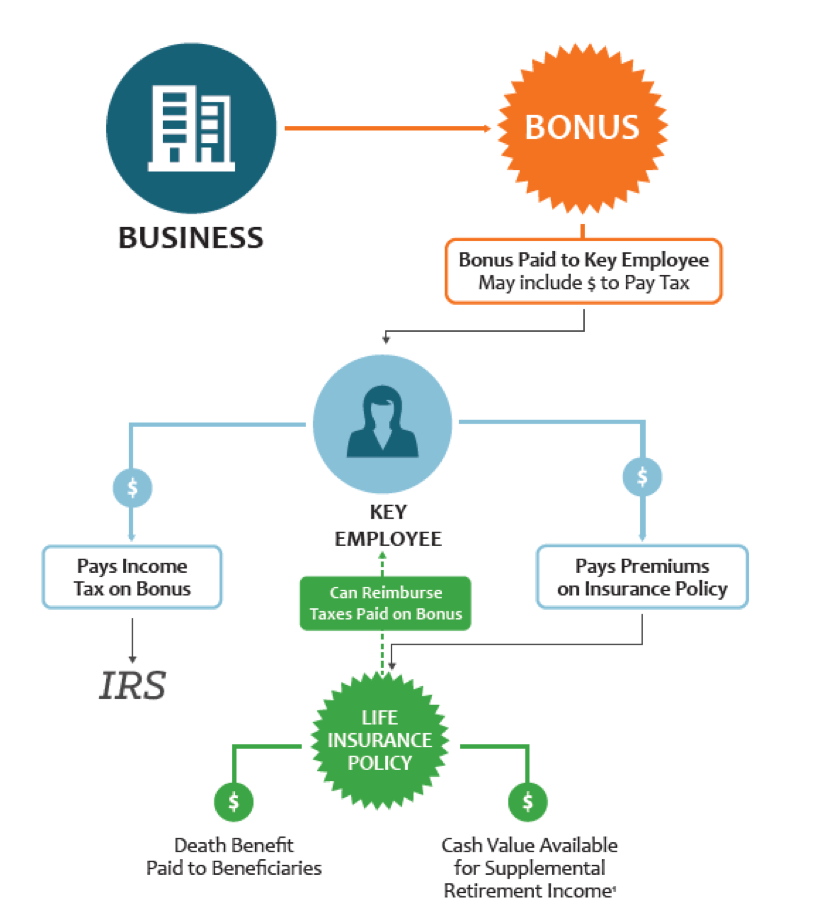

If you are a business owner you recognize the contribution of your employees to the success of your business. One smart way to reward them for their efforts and increase their loyalty is to offer an executive bonus program that can help employees work towards their protection and retirement goals. An executive bonus plan is an arrangement between your business and a key employee whereby the business agrees to pay the premium on a life insurance policy, owned by the employee.

Here’s How an Executive Bonus Plan Works:

- Your business provides a bonus to your employee to fund a permanent life Key Man insurance policy

- The bonus is used to pay the policy premium (either in cash to the employee or directly)

- Since the bonus is considered income to the employee, taxes will need to be paid. There are a number of options on how to pay outstanding income taxes:

- Paid out of pocket from the employee

- Paid by business in the form of an increased bonus amount to cover the amount of the tax

- Paid out of pocket from the employee and reimbursed through a loan from the policy

- The employee is the owner of the policy and will benefit from the death benefit protection and any accumulated cash value that can be used to meet a variety of needs.

Benefits to Your Business:

- Can select with employee(s) can participate

- Not subject to restrictions of qualified plans

- No IRS approval is needed

- Flexibility to customize plan

- Bonuses are immediately deductible as long as they are reasonable

- Ability to restrict access to cash value to encourage employees to stay

- Benefits to Key Employee:

Helps fill the retirement income gap

- Gain the potential for tax-differed growth of values

- Income tax-free death benefit protection for family

- Income tax-free supplemental retirement income potential

- Access to cash for emergencies

- Disability, a variety of optional benefits

- May be able to contribute additional amounts to the policy

- Policy is typically a portable benefit that the employee can take with them

Copyright © 2020

Business OwnersRelated Insights

June 5, 2023

FAQs on LTC Insurance and Your Taxes

ShareIf you or a loved one needs long-term care (LTC) services, there are insurance products that can help cover the …

Read More navigate_next

May 2, 2023

Podcast: 8 Questions to Consider Before Buying Life Insurance – A Needs Analysis

ShareMay 2, is Life Insurance Day, and marks the anniversary of the first day that life insurance became available in …

Read More navigate_next